The amount of investment dollars that have flowed into companies where there is a perceived positive impact for the environment, people, or social justice has grown significantly over the last few years. Investors want to see their dollars not just show a positive return on investment, but a positive impact on the planet. Therefore, investment firms (Venture Capital, Private Equity) are under more and more pressure to show the measurable positive impacts of the companies in their portfolios.

This guide will explain how to take the variety of data as inputs from your private portfolio companies, and use standardized frameworks to report on the impact of your assets.

Before we jump into details, let’s start by defining impact measurement and ESG investing.

The diagram below shows how we define impact and ESG and their defining reporting traits.

Investment Type | Impact Investing (includes thematic investing) | ESG Investing | Traditional Investing with no ESG criteria considered |

Reporting Type | Positive Impact Screen | Negative Impact Screen | No Extra-Financial Reporting Considered |

We see both impact and ESG reporting as extensions of accounting practice.

Impact and ESG investing are driven by non-financial considerations. This can make these growing investment practices look unstructured and undisciplined when compared to the financial accounting analysis that underpins more traditional investment frameworks. Impact and ESG measurement, management, and reporting have stepped in to fill this gap. The practice of impact and ESG reporting are focused on filling the following needs:

In our experience, asset managers may start with 1 or more of the above objectives, but ultimately, all of these objectives will eventually be required.

The benefits of ESG and impact measurement in this new world of impact investing is now well established. But it’s not easy… if it were, everyone would already be doing it. ESG and impact measurement is a new field and practitioners face a number of challenges when launching a successful impact and ESG reporting process. These are:

1. Establishing the most immediate objectives of your ESG and impact reporting initiatives. As noted above, given the current dynamic nature of ESG and impact reporting, try and also consider how any non-immediate objectives will come into play in your environment,

2. Establishing which impact and ESG frameworks you are likely to adopt. For example, your team should consider the following frameworks:

Reporting Framework | Particularly Suited for | Often critiqued for | Contains data strategy?* |

Sustainability Accounting Standards Board | SASB is pretty strong in most areas of impact | SASB is often critiqued for being focused on more mature companies when VC and PE focuses on younger startups | Yes |

Impact Reporting & Investment Standards+ | IRIS+ was initially developed by stakeholders that included Acumen Fund. Acumen works in developing contexts, and this is reflected in the metrics available in IRIS+. Therefore, IRIS+ is good for agriculture, environment, nutrition, and disaster contexts. | Lack of health and safety and supply chain metrics | No |

United Nations Sustainable Development Goals | High level metrics across a portfolio | Being very high level, these metrics are often better for advocacy or NGO work. However, mapping custom metrics to the UN SDG goals is common and should be pursued where possible. For an example of where this has been done previously, check out the IRIS+ indicators. | No |

Impact Management Project (IMP) | Understanding the scope of impact | Not having specific impact metrics. We recommend using IMP in conjunction with one or more of the reporting frameworks above. | No |

3. Review the above frameworks and identify metrics and indicators you will be reporting against. You may find that there are some metrics that are missing, in which case you can custom create metrics. For example:

4. Create the data architecture for each metric. What we mean by data architecture is:

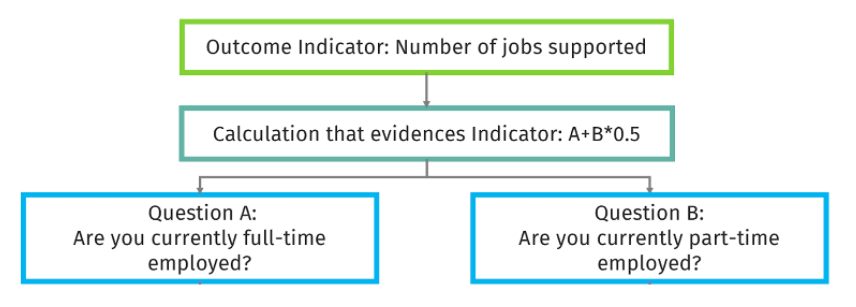

Below is an example of data architecture for a simple metric. This needs to be created for every metric that has been developed.

5. Establish the frequency of data collection. This is going to depend on how frequently you need to report data based on your ESG and impact reporting objectives.

6. Once you’ve created your data architecture, it’s time to put it all into practice. You can choose a software provider, or dependent on budget, also create a DIY approach using Google Forms and Google Sheets, or spreadsheets. If you’re using a DIY approach, the structure needs to look something like this:

7. Remember to create and implement a training program for your internal staff and portfolio companies. This should cover:

We’ve reviewed the key steps to measuring impact and ESG. In order to put this into practice, here are some options:

These options with their average implementation timelines are listed below:

This guide reviews the options available to asset managers in private markets. Regardless of whether you implement an ESG/impact measurement platform, or go about it with spreadsheets/forms, you should follow these steps to turn the qualitative impact data into quantifiable numbers that your investors want to see.

One last point as you launch into your impact and ESG reporting – burgeoning regulatory requirements are pushing private asset managers to adopt impact and ESG reporting systems. Adopting a system that is easily changeable and flexible to dynamic requirements is essential.

As Founder & CEO of SAMETRICA, Anshula brings 10+ years of experience in non-profit, private, and public sectors. A recognized expert in impact metrics, she is passionate about using social impact to drive business profitability.

Spread the word