Why do impact investors want to show the Impact ROI?

Imagine if you could tell the story of your impact investments with one key metric that could be generally understood by impact-skeptics and believers alike, and if you could easily break down and communicate the components of that number in conversation? Even better, what if you could start showing how your impact returns compared to your financial ones as a “blended return”? If it sounds too good to be true, it’s because it often is.

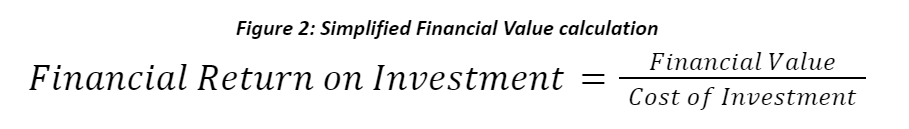

The idea of blended returns is not new, and was popularized by Jed Emerson to describe social, financial, and environmental value created by an organizations’ activities because “value cannot be bifurcated, and is inherently made up of more than one measurement of performance”. Ultimately, the takeaway for blended returns is that:

- There is more than just one type of value. In addition to the financial value creation opportunities available in the market, there are also social, economic, environmental, and governance value creation opportunities.

- Communicating these different types of value in one language highlights that:

- There is no conceptual hierarchy between one return over another. A specific investor may value one type of value over another, and that is okay, but as a principle across markets, these returns are comparable in value.

- Investors can manage (i.e. make tradeoffs or optimize) their investment decisions based on a broad set of return types.

- Investors can benchmark and compare investment opportunities and fund/portfolio manager performance across a broad range of value types.

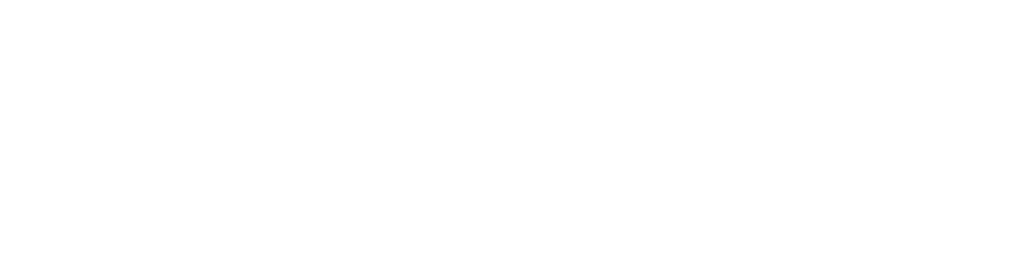

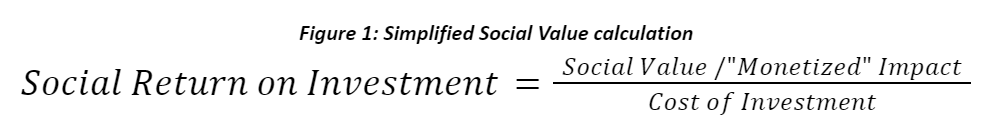

Realizing the promise of blended value is dependent on measuring impact¹ using the language of finance, and most commonly, this means using the Return on Investment (ROI) ratio to do so. At a high level, this ratio looks like this:

Table 1: Simplified economic example of monetizing impact

Outcome | Indicator | Financial Proxy This is the formal term for values that monetize outcomes. | ||

Description (in words) | Value ($) | Unit | ||

Increased employment opportunities | Number of jobs created | Increased income generated for individuals who have attained a new job | $35,000 | Per year |

Increased income tax revenue generated for government for those who have attained a new job | $2,500 | Per year | ||

Decreased social assistance payments paid by government as a result of new employment created | $7,500 | Per year | ||

Outcome | Indicator | Financial Proxy This is the formal term for values that monetize outcomes. | ||

Description (in words) | Value ($) | Unit | ||

Decreased greenhouse gas emissions | Number of tonnes of carbon emissions reduced | Market value of carbon credits for one tonne of carbon emissions using the Canadian federal price of carbon | $50 | Per tonne |

Market value of carbon credits for one tonne of carbon emissions using the international price of carbon (International Monetary Fund recommendation). | $75 | Per tonne | ||

Outcome | Indicator | Financial Proxy This is the formal term for values that monetize outcomes. | ||

Description (in words) | Value ($) | Unit | ||

Increased healthcare outcomes for individuals with poor access to primary care | Number of decreased emergency room visits (when compared against baseline) | Decreased hospital expenditure on emergency room visits | $125 | Per visit |

Decreased hospital expenditure on ambulance rides | $250 | Per ride | ||

Increased income that can be achieved because hospital visit has been avoided (income earned over the average hospital stay) | $2,000 | Per visit | ||

Challenges to Implementing an Impact ROI Model

The benefits of adopting the concept of blended value through impact measurement seem self-evident. Specifically, General Partners can:- Speak to Limited Partners in vocabulary that is already familiar to them.

- Have a competitive advantage over those GPs that only communicate only financial returns due to the additive nature of blended value.

1. Identifying the right valuations of impact: Identifying the right financial proxies requires either a pre-existing list of financial proxies, or a deep expertise in valuations and economic theory.

2. Making these calculations credible: Even if there is a pre-existing list of financial proxies, these almost always have to be adjusted for location, region, and demographic specific contexts. For example, even the relatively simple examples shown in Tables 1 to 3 require adjustments. Some examples are:

- Table 1: Increased income generated for individuals who have attained a new job. This value needs to be adjusted for the following:

Financial Proxy This is the formal term for values that monetize outcomes. | Sampling of Adjustments Not a full and complete list | ||

Description (in words) | Value ($) and unit | Description (in words) | Source |

Increased income generated for individuals who have attained a new job. | $35,000 per year | How many jobs would have been created anyways by industry | Bureau of Labor Statistics or Statistics Canada |

Income disparity based on gender and ethnicity | Secondary peer-reviewed sources | ||

Length of employment tenure | Bureau of Labor Statistics or Statistics Canada | ||

3. Applying these calculations to previously collected data: Given the initially heavier lift of disclosing blended value propositions, many investors choose to forgo this approach at the beginning of their impact reporting journey thinking that it can be easily added at a later time. While this is sometimes possible, often the initial data strategy misses key data points that are needed to convert impact data into a blended value statement. To resolve this, impact investors should consider blended value in their data strategy at the outset.

4. Doing these calculations on an ongoing basis. Given the lift on both applying the adjustments necessary to make an ROI statement credible, it is often not feasible for impact investors to take on these calculations for every reporting period leading to a lack of inter-period comparison and analysis even within one investment portfolio.

5. Actually comparing ROI data. Even if the above barriers are resolved for any given analysis, there is a great deal of subjectivity in how various impact reporting professionals approach these challenges. Comparing across different metrics, then, continues to be a challenge.

So, while we can all see the pot of gold at the end of the rainbow, communicating the true blended value of a portfolio has traditionally been seen as impossible.

How to resolve challenges in adopting Blended Value for calculating Impact ROI

There are now several options to alleviate many of these challenges. The table below summarizes the current solutions:

Does this vendor type resolve the challenge? | ||||

Challenges to Adopting Blended value | Consultants | Spreadsheets | Impact Measurement & Management Providers | SAMETRICA |

Identifying the right valuations of impact | Yes! Qualified consultants can help create right valuations. | No. But most consultants use spreadsheets to capture the right valuations. | Maybe. Most IMM providers have an in-house team of analysts who can help. | Yes! SAMETRICA has a team of qualified impact analysts who specialize in this. |

Making these calculations credible | Yes! Qualified consultants can help create right sourcing and calculations. | No. But most consultants use spreadsheets to capture the right adjustments. | Maybe. Most IMM providers have an in-house team of analysts who can help. | Yes! SAMETRICA has a team of qualified impact analysts who specialize in this. |

Applying these calculations to previously collected data (Assuming that blended value concepts were considered previously) | Maybe. Using data that was not previously created with a Blended Value approach in mind is extremely messy and error prone because the data needs to be reformatted. | No. But most consultants use spreadsheets to apply calculations. | Maybe. Most IMM platforms have an “SROI Calculator” where previously collected impact data needs to be entered in aggregate form. This is messy, error prone, and not verification-friendly. | Yes! SAMETRICA’s platform pre-formats the data in a way where financial proxies and adjustments can be layered on top of previous impact data and automatically generates an ROI. |

Doing these calculations on an ongoing basis | Maybe. Cost is often a factor here such that these calculations can only be created on, at best, an annual basis. | No. But most consultants use spreadsheets to complete analysis. However, these are often messy and will be difficult to use for data integrity testing. | Given that most IMM platforms use a separate “SROI Calculator” (see row above), there is a marginal cost (at the very least, in terms of time and effort) to create an SROI calculation. | Yes! Given that SAMETRICA’s platform is able to simply layer on financial proxies and their adjustments on pre-existing data, there is no additional effort to create ROI calculations as frequently as impact data is created. |

Comparing ROI data | No. Varying data quality, approaches, and different metrics across many different Excel spreadsheets makes this tactically impossible. | No. Varying data quality, approaches, and different metrics across many different Excel spreadsheets makes this tactically impossible. | No. Most IMM platforms use a separate “SROI Calculator” (see row above), there is no way to adjust for different metrics or approaches used in different analyses. | Yes! See the next section for an explanation of how we approach this. |

The idea that ROI calculations cannot be compared has been studied (and studied again), discussed (and discussed again), and accepted as fact by impact measurement vendors for decades. SAMETRICA has been resolving these challenges using the following concepts and technologies:

- Creation of the concept of “Marginal Verifiable Cost and/or Value”. The idea behind a financial proxy is that whenever an outcome is achieved, there is a new value created, or a cost avoided. One of the common challenges of coming up with financial proxies is that there are few clear, verifiable approaches to creating these numbers. SAMETRICA created and refined the idea of “Marginal Verifiable Cost and/or Value”. There are three components to this concept:

- Marginal: An incremental increase or decrease that does not consider fixed costs. As an example, looking at Table 3 (“Simplified healthcare example of monetizing impact”) the financial proxy “Decreased hospital expenditure on emergency room visits“ should only consider the net new costs that are incurred for every emergency room visit. So, the operational costs (i.e. doctor’s salaries, building maintenance and mortgage costs) should be excluded from the analysis. This ensures the analysis is conservative and only includes costs that would not have been considered otherwise.

- Verifiable: The financial proxy should be able to be supported with documentation, or as we refer to it “the receipts”. Using the example of emergency room visits, we could find the costs associated with additional emergency room visits by looking at the cost of doctor consults that would not have happened otherwise and are billed through the hospital (i.e. a “receipt” or some sort of papertrail exists), the cost of materials (i.e. casts or wound bindings) that have their usage identified in doctor’s notes.

- Cost or Value: We only use financial proxies that fall into one of two categories:

- Cost avoided: This is a transaction that:

- Would have occurred, but did not for a benefiting stakeholder;

- Would leave the benefiting stakeholder worse off according to the theory of change.

- Value created: This is a transaction that:

- Will occur, but would not have otherwise for a benefiting stakeholder;

- Would leave the benefiting stakeholder better off according to the theory of change.

- Cost avoided: This is a transaction that:

Even with the clear concept of financial proxies above, financial proxies are not immediately comparable to each other. That’s because theories of change can differ and even oppose each other. So, a “cost avoided” in one theory of change would be a “value created” in another, or may not even feature as a financial proxy at all. This is ultimately why different Impact ROI (or SROI) analyses are not considered comparable to each other.

To resolve this issue, we need to be able to use technology that enables us to see the same data through many impact frameworks. As previously noted, each impact framework has a level of subjectivity that is built into its construction. The only way to be able to compare impact ROIs across various investments is to use the same framework. However, each impact investor will have a different thesis, and therefore a different theory of change. The data in SAMETRICA follows the data architecture in the figure below.

Conclusion

Impact ROI can be a powerful tool to quantitatively evidence an impact investing thesis, and continues to be a competitive advantage in growing assets under management. The ability to compare impact ROI is a growing area, with great forward strides on creating more comparability across different analyses. However, first and foremost, calculating and communicating impact ROI creates a quantitative, defensible, evidencing impact created by investors.

¹Emerson, Bugg-Levine. Impact Investing. Pp 172.